ADA Price Prediction: Analyzing the Path to Recovery in 2026

#ADA

- Technical Foundation for Recovery: ADA price holding above the 20-day moving average while MACD bearish momentum weakens provides a tentative technical base for potential upward movement.

- Conflicting Fundamental Signals: The bullish long-term roadmap for 2026 clashes with near-term negative sentiment from reported institutional selling, creating a high uncertainty environment.

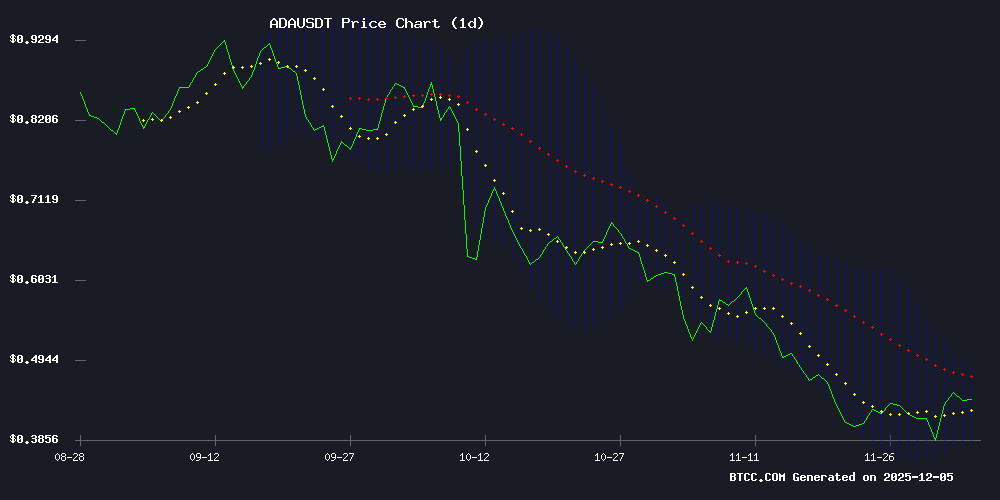

- Critical Price Levels to Watch: A sustained break above the Bollinger Band middle line ($0.433) could signal trend change, while the upper band ($0.482) and lower band ($0.384) define the near-term trading range.

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Building

According to BTCC financial analyst Robert, ADA's current price of $0.44 sits above its 20-day moving average of $0.433, indicating a potential shift toward bullish momentum. The MACD reading of 0.020832, while still below its signal line at 0.044940, shows the bearish momentum is weakening as the histogram sits at -0.024108. The price is currently trading within the Bollinger Bands, with the upper band at $0.482 and the lower at $0.384, suggesting a period of consolidation. Robert notes that a sustained break above the 20-day MA could signal the start of a recovery phase toward the upper band.

Market Sentiment: Founder's Vision Contrasts with Holder Behavior

BTCC financial analyst Robert assesses that current market sentiment for ADA is mixed. The announcement of Cardano founder Charles Hoskinson's 'Pentad Blueprint' for 2026 provides a long-term bullish narrative for ecosystem growth. However, this is counterbalanced by reports of an 'institutional exodus' and long-term holders liquidating positions, which creates near-term selling pressure. Robert suggests that while the roadmap may foster investor confidence over time, the current outflow from key holders aligns with the technical picture of consolidation and must be monitored closely.

Factors Influencing ADA’s Price

Cardano Founder Reveals “Game Plan” For 2026, But Can ADA Price Still Recover?

With 2025 drawing to a close, Cardano founder Charles Hoskinson has outlined an ambitious roadmap for 2026, aiming to position the blockchain as a dominant force in decentralized systems. His vision hinges on resilience—acknowledging inevitable setbacks while emphasizing rapid adaptation.

ADA's price performance has lagged behind major altcoins this year, but Hoskinson's strategic pivot could recalibrate market sentiment. The plan focuses on systemic improvements rather than short-term fixes, suggesting a long-term value proposition for the network.

Key to this transformation is Cardano's ability to learn from operational challenges. Hoskinson's candid admission of past difficulties—and his confidence in overcoming future obstacles—signals a maturation phase for the protocol.

Cardano Founder Unveils Pentad Blueprint for 2026 Ecosystem Growth

Charles Hoskinson has positioned Cardano's newly formed Pentad as the missing executive LAYER in its governance framework. The initiative links five entities—Cardano Foundation, Emurgo, Input Output, Midnight Foundation, and Intersect—to drive infrastructure deals, DeFi expansion, and institutional outreach.

The first mandate focuses on securing critical integrations like bridges, stablecoins, and oracles. This 'try before you buy' approach tests the coalition's ability to function as a unified growth engine ahead of 2026 targets.

Cardano Faces Institutional Exodus as Long-Term Holders Liquidate Positions

Cardano's blockchain analytics reveal troubling capital flight, with 114.66 million ADA coins moved by long-term holders this week—a 23% surge in aged token circulation. The altcoin failed to capitalize on early-week gains, remaining trapped in a descending channel that now threatens new lows.

Technical indicators paint a conflicted picture: The TD Sequential flashes a rare buy signal while MACD hover NEAR a death cross. 'When whales exit quietly, retail traders often hear the crash too late,' notes on-chain analyst Ali Martinez, who nonetheless identifies potential oversold conditions at current levels.

Market structure suggests institutional caution prevails. The Spent Coins Age Band metric—a reliable gauge of smart money movement—shows accelerating divestment from ADA's most experienced holders. This silent exodus contrasts with speculative retail interest in meme coins and newer Layer 1 protocols.

Is ADA a good investment?

Based on the current technical and fundamental data, ADA presents a high-risk, high-potential investment case for 2026. The technical setup shows early signs of stabilization, with price above the key 20-day moving average. Fundamentally, the conflict between the founder's ambitious 2026 'game plan' and the reported selling by institutions creates uncertainty.

Key Data Summary:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.44 | Trading above 20-day MA ($0.433) |

| 20-Day MA | $0.433 | Potential support level |

| MACD | 0.020832 | Bearish momentum weakening |

| Bollinger Upper Band | $0.482 | Near-term resistance target |

| Bollinger Lower Band | $0.384 | Near-term support level |

Investment suitability depends heavily on risk tolerance and time horizon. The promised 2026 ecosystem growth could catalyze a significant price recovery if executed successfully, making it a speculative buy for long-term believers. However, the reported institutional selling suggests waiting for a clearer trend reversal confirmation might be prudent for conservative investors.